What should I invest in? “

This question has been asked to me more than I can remember in the past year. This makes sense since I have a finance blog.

Over time, my answer has evolved. In two years, I would’ve given you a detailed description of the SPAC that I invested in and why. I would have recommended index funds two months ago because it is almost impossible to beat the market.

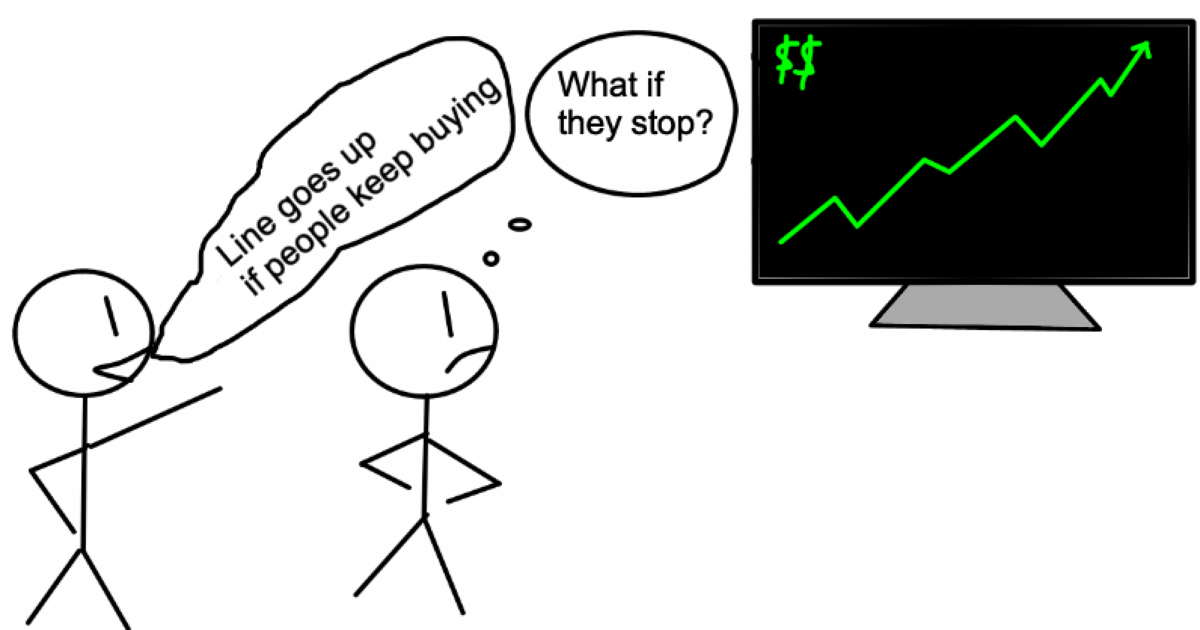

Although I still agree with the answer I gave in my second question (after all, my money is mostly invested in index funds), I now realize that my response was incomplete. In most cases, yes, I think you should invest in Index Funds. Active trading is difficult because the market can be unpredictable, particularly in the short term. Index funds are more than just “you can’t probably beat the market.”

We are often confused about the investment goal. The goal of investing is not to get the highest percentage return. Your goal is to earn money over time. It doesn’t matter how you achieve this. It may seem counterintuitive at first, but please stick with me.

The thread started by James Camp gave me a lightbulb.

The problem with investing small amounts of money is that even if you get a high return, you won’t make much money.

Stock market returns of 20% are incredible.

The 20% return on $1,000 is just 200 dollars. https://t.co/affVKBGXjc

James Camp (@JamesonCamp).

Apr 18, 2022

James has pointed out that high returns on small capital amounts don’t really move the needle. returns are only outsized when you have lots of capital. It’s cool to make 100% on a $10,000 portfolio. It won’t change your life. I’d take a 10% rate of return on $1M any day over a 100% rate of return on $10k.

The percentage return on investments is only part of the equation. How can we maximize the absolute return?

Opportunity costs

Imagine that you have $25,000 in cash. Let’s look at two scenarios.

Scenario A

You are interested in trading. You believe you can beat the market. Over the course of the year, you will spend a lot of time studying the market and developing your strategy. Over the next year, you actively and aggressively invest your $25,000 in the market.

Trading is a binary decision. Either you will outperform the markets, or not. The odds are not equally distributed, even though the outcome is binary. Most people will not outperform.

Let’s assume that you belong to the minority of people who do outperform the market. Let’s take it a step farther. You absolutely crush your market and generate 100% returns. Okay. You can do it again. Can you do it again? And again? If so, fantastic. Continue reading.

You *probably* won’t. You won’t know until the years pass if you are able to.

Scenario B

You don’t want daily trading, but you want to invest. You decide to invest $25,000 into the S&P 500 and develop a new skill. You can learn coding, writing, a second language, Excel or sales. You could start a blog or podcast. You decide.

You won’t be able to outperform the stock market after a year. You will match the market exactly. You will learn a skill you can use to earn more money. You might get a job or a promotion. Or you could start a side business, find a new one, or do something completely different. In scenario B, your worst case is to earn market returns while developing a new skill. The best outcome is that you make a lot of money with your new skill. Guess what? This extra capital can be invested in the market.

Both scenarios require the same time to develop a skill. However, the outcomes can be very different.

In investing, a novice with little experience has a distinct advantage over seasoned professionals. You can spend a thousand hours improving your skills, studying the markets and backtesting strategies. You underperform because market conditions have changed. If your trading strategy is reliant on one asset class or a particular market environment, then you may be at a disadvantage.

If you spend a whole year learning French, it won’t happen overnight. You won’t suddenly be unable to program if you master Python. You won’t become illiterate if you start a blog.

You can tell quickly if you are improving in French, Python or writing. Trading? You might be lucky, or you may just be good at trading. You won’t be able to tell for some time.

Nick Maggiulli nailed it in an article last April.

What about stock picking? How long does it take to decide if someone has the ability to pick stocks?

What is an hour? What is a week? What is a year?

Even if you wait for several years, you may still not be sure. It is difficult to establish causality in stock picking. The result of a computer program or a basketball shot is immediately apparent. The ball either goes through the hoops or not. The program will run correctly or not. Stock picking is different. You make your decision and then wait to see if it pays off. The feedback loop may take many years.

Nick Maggiulli

This brings me to my next point, the opportunity costs of trading. You can either spend your time learning how to trade or developing another skill. We only have so much time. You need to make the right choice. By default, the hours that you spend trading are hours that could not be spent on developing something else.

Remember . The goal is making more money. You will outperform the market indexes if you focus on trading. You are wasting your time if you cannot consistently earn more than the market.

I would have a different opinion if the market was only for traders and there were no methods of passive investing. The truth is that anyone can profit from the market. Engineers, writers, doctors, professors, and musicians can all benefit from the 9% return on average (the historical market average) while earning income elsewhere.

The trader must make money on the market, and only the market.

Trading carries the risk of underperformance, or even loss. There is no guarantee that you will outperform. Passive investing ensures that you match the market’s performance (for better or for worse) while also giving you an opportunity to earn more money and learn a new skill.

The opportunity costs of trading are, in essence, any other skills that you could develop to make more money.

What is Alpha?

We focus heavily on alpha, or outperformance in the world of investing. Investors that can outperform broad indexes like the S&P 500, are considered to be the best. The 15-20% annualized return over a long period of time is legendary. We view investing alpha as a bubble where we compare the financial returns of investors to S&P 500.

We ask “What investment strategy produces the highest returns?” We should ask, “What is the best overall strategy to generate money?” “

It shouldn’t be your entire financial process.

When you look at percentages, if the market returns 10% and you make 20%, then you have generated significant alpha. How many hours did it take you to earn that 10% extra? How much did you make?

You made a profit of $10,000 if you earned 20% on an investment of $50,000. You spent 500 hours researching the market in order to get this result.

Would you have been able to earn more than $10,000 if you had invested the 500 hours you spent in trading into developing another skill? What about starting a new business?

Here’s where “alpha”, the term, gets lost. True alpha doesn’t mean outperforming S&P percent returns. True alpha is when you generate more money through active trading than what you could have made working on another venture.

This is the cost of active trading. Even a great return on investment that falls short of other options is a loss.

My $0.02 Find something anything that you can do to make a lot money, unless you’re Jim Simons. Then invest the excess income you have in the stock market. Nobody cares whether you earned 5%, 10%, 15% or 50%. I can promise you that the guy who earned $1M in his business, and 10% on his investment portfolio is more impressive than one who makes 25% on a $100,000 portfolio.

Opportunity costs are more important than monetary costs in the quest for alpha.