I am a poker player. I play poker a lot. The greatest game of all time is played at a poker table where skill, money, luck, adrenaline and probability are combined.

I was in London last Tuesday with my friend Jake. We are both poker enthusiasts, so we visited the Hippodrome Casino located in Soho. Three hours later, the PS120 I had paid for my buy-in was nearly tripled.

It would have been the responsible and right decision to withdraw your money from the casino, leaving you PS230 richer. And I had planned to do that.

On my way to the cashier I passed a few roulettes tables. I thought, “PS350 would be really awesome.”

It felt good to throw PS350 onto red. You can probably guess that the ball landed in black. Adios, PS350. This was a bad decision in retrospect (and real time). I spent three hours earning PS230 at the poker table and gave it back to the casino with a single fatal spin.

What is going on?

Enter The House Money Effect

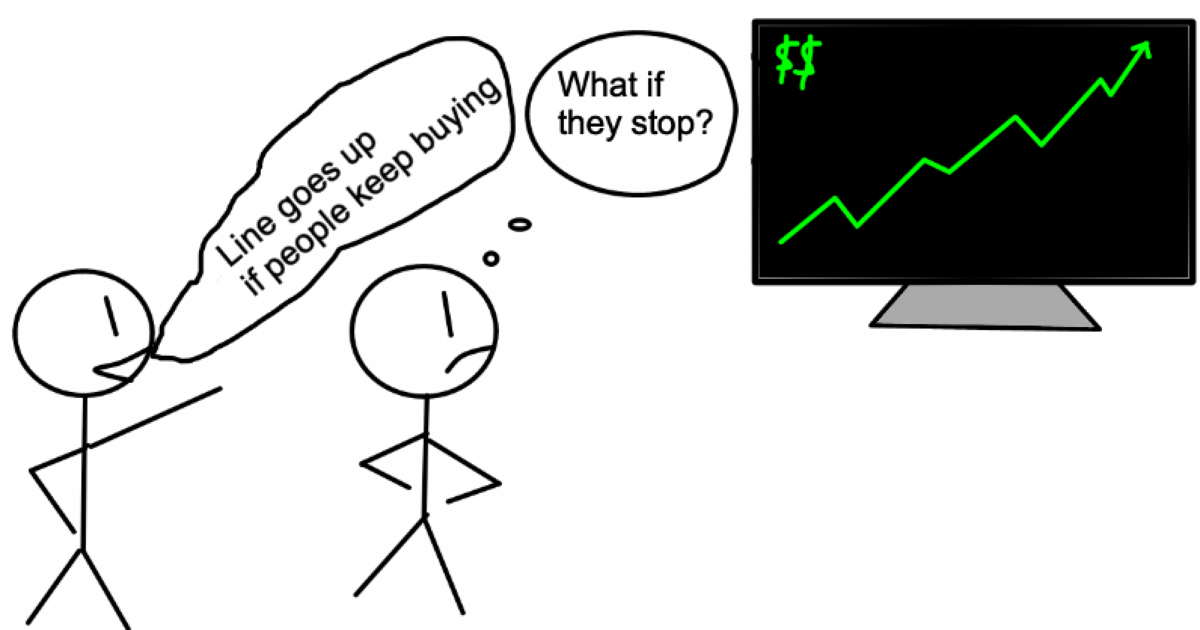

According to Investopedia, the house money effect is used to explain why investors tend to take greater risks by reinvesting profits earned from investing rather than when they invest their savings or wages.

You can’t really call poker “investing” but you get my point.

If I had “earned” my PS350 through conventional means, I’d have been less inclined to risk all of it on the turn of a roulette wheel. However, I did not “earn” the majority of it. In my mind, I felt that I was only putting my first PS120 at risk. The other PS230 is money from my house.

The house money is not just a casino phenomenon. It’s everywhere, from equity markets to sporting events. Crypto is the one sector where you see it more than any other.

Young Money

Over the past decade, crypto has made an incredible amount of money. It’s not just the money that was made. The most shocking thing is not the amount of money made, but the speed at which it happened and the age group who benefited the most.

Our attention spans are shorter and our memories more erratic than ever. Ethereum traded at $116 in March 2020. Since then, it has almost 40xed. It’s not normal to see 40x growth in just a year-and-a-half.

Who are the most likely people to purchase crypto during 2020’s crash? Young investors.

Perhaps they felt excluded by the traditional market. Maybe they felt that the system failed them. Or perhaps they wanted to make quick money. Young investors have flocked in large numbers to crypto, and now there are thousands of crypto millionaires aged 20 and older. This is a huge dopamine rush.

Why am I bringing up crypto? This fascinating Twitter thread is what first introduced me to “The House Money Effect”.

I didn’t have to wait long in the crypto-world before I realized that the “House Money Effect” is driving the ecosystem.

After spending countless hours playing high stakes poker, I immediately recognized this pattern and can’t seem to stop seeing it. A short

— fintechjunkie.eth (@fintechjunkie)

Dec 2, 2021

This thread was an enlightening and wild read. No one wants to read a 12-tweet-thread that is linked in an email. This thread has been converted into a PDF and I’ve made it available to you directly:

Never before has so many young people made so much fast. It is addictive.

Never traded cryptocurrency. I probably won’t. I know. I don’t play “HAVE FUSS STAYING POOR!” I’m only 20. At one time, I made a lot of cash in a short period of time. And I understand exactly what it feels like.

In-tox-i-cat-ing.

You and 100 strangers on the internet are all exchanging emojis in an online chatroom as you get rich. You can watch the market wake up and bid up your investment by 500%. Finding the next play and parlaying gains after gains.

You begin to feel like you’re a genius because you must be one if you make so much money.

Poker. Crypto. SPACs. Three games played in the same manner. You can win big with a high-risk appetite and lucky timing.

Money made over night doesn’t seem earned. It’s just a number. You start to chase that rush or, as Fintechjunkie puts it, “chasing a dragon.”

The young (including myself) are known to be dumb. Many young people today are extremely wealthy. To get rich fast, it’s important to be notoriously stupid (or, at least have a high risk tolerance).

It is impossible to be rich if you are notoriously stupid (or, at least have a high risk tolerance).

Getting Rich vs. Staying Rich

Morgan Housel published a wonderful article four years ago on the difference between becoming rich and remaining rich.

Getting rich vs. staying rich.

https://t.co/z66rT2Uq21

Morgan Housel

Feb 17, 2017

This essay is full of gems, but I think my favorite line is:

I’ve noticed that getting rich is often the greatest obstacle to remaining rich.

This is how it goes. You become more confident that you’re doing something right the more you succeed. You’re less likely to be open to change if you’re more certain that you do it correctly. You are more likely to trip in a constantly changing world if you’re not open to change.

There are many ways to become rich. There’s only one thing that will keep you rich: humility, sometimes to the point where it borders on paranoia. Ironically, few things can squash humility more than becoming rich. .”

On Twitter, you see this all the time. Crypto gurus that were early adopters of Bitcoin and Ethereum. Growth investors who will make a killing in 2020 on high beta stocks. Your friend who built a six-figure Robinhood account within a few short months.

All of them think they are geniuses.

How do I know this? I made $400k by trading SPACs. Why would I ever listen to my father and remove some chips from the table? I was more than 5000% up. If I could just gain another 150%, I’d be a millionaire.

When I say I’m ignorant, arrogant or foolish, I really am.

Every other twenty-something who has made a lot in a short period of time is probably ignorant, arrogant and foolish. You cannot make such a large amount of money so quickly without arrogance.

The arrogant fools believe they are geniuses investors. When you think that you are an investor genius. When you believe you’re invincible. When you believe you can control the market with your fingertips.

The market can be a very funny place. This humbling can look like a sure-fire win.

Poker’s Most Dangerous Hand

What is the worse poker hand? 2-7 off suit.

The lowest two cards are those that can’t make a straight. (There are five cards from 2 to 7). They will still make a very poor flush even if they’re suited. If either of them makes pairs, that is also a low-ranking hand.

The worst hand, however, is not the most dangerous. Even novice players are aware that their odds are bad with a 2-7 and can play accordingly. The best hand is the most dangerous.

Imagine starting with a Jack of Spades and an Ace of Spades instead of the usual 2-7. Unknown to your opponent, he starts off with a pair twos.

If you don’t know anything else, your odds of winning are 50-50.

The flop is King of Spades, 10 Of Spades, and 10 Of Clubs. You are one card away from a full house, or straight. Now you have a chance to win 65% of the time. You raise and your opponent calls.

The Queen of Diamonds then comes out.

Straight

You raise, your opponent calls. You have a 90.91% chance to win the hand by the time it reaches the river.

The 2 of spades is thrown on the river.

Flush

You know that you are in a good position. You were in a great position with the straight, but you got a flush when you played 2 of Spades. Ace-high flush is what you want.

So you go all in.

What about the two spades? What about the two of spades that gave you your flush?

Your opponent now has a full house. He calls you all-in. A full house is better than a flush.

Only four of the 1326 combinations of hole cards could have defeated you: pair Kings, pair 10s, queens or 2s. Your opponent, however, had a pair 2s.

The 2-7 off suit is not the most dangerous poker hand. You bet on the hand that is 99% successful, but only 1% of it.

Pocket 2s ruined the Ace-high flush.

It’s not just about poker. It’s a thing for everything.

The crypto-speculator, who has never lost a trade but is locked out of their wallet. SPAC traders who are snared by warrant terms they missed in the prospectus. Investors who take a “sure thing” and commit accounting fraud. It can be a number of things.

Pocket 2s is the most dangerous poker hand. The only way to make money quickly is by playing as if the pocket 2s never happens.

Morgan stated, “The more you succeed at something, you become more confident that you are doing it right.” The more you believe you’re doing something right, the less you’re open to change.

When you are rich and ignore the 1% financial ruin risk, you begin to believe that it won’t happen. This leads to the 1% hitting eventually. Sometimes at the worst possible times.

What we do vs. what we should do

Stopping is the ideal behaviour for those who have become rich quickly. You made a million by trading dog coins? Invest in real estate. Buy ETFs. Spend the money. Anywhere. You won’t want to risk losing it all. We don’t because we prefer to double down on our strategy that got us rich.

We have people who are “Slumdoge millionaires” and made millions of dollars on a meme wager…

They never sell.

It doesn’t feel like real money when you play with it. It doesn’t really matter how you feel. It’s real. Once you’ve blown your money on the house, it is unlikely that you will be able to recover any of it.