Financially Responsible

You’ve probably heard some of these sentences about money.

Be responsible with your finances. “

Are you sure you want to buy that? “

Think about other ways you can spend the same amount of money. “

You need to save more. “

This is the Venmo caption I sent to my roommate when we celebrated one of our best friends’ bachelor parties in Vegas last weekend.

We literally burn money

A slightly different tone, yes?

Las Vegas is expensive. Everything in Las Vegas is expensive. Even more expensive are the drinks. The servers are attractive and walk through every bar or club along the strip, offering Grey Goose bottles at 10x their original price. The casinos themselves are awash with flashing lights, filled with the cheers of gamblers who have won big at roulette and craps.

Las Vegas, an adult Disney World, is designed to drain your wallet of every last dollar. The house almost never loses.

My friends and I did not make an exception last weekend.

What’s this? That’s okay. This post is not about being financially savvy, but the opposite. In this post, we will discuss why it is okay to be irresponsible financially.

Although it may seem counterintuitive to embrace irresponsible expenditure, this is one of the most responsibly things you can do.

You must understand that the only purpose of money is for it to be spent. Discussion over.

What is the purpose of money? Who spends money, on what, and when?

Spend it now or later. Spend it for yourself or on someone else. After you die, it can be left to your family. Money is only useful for buying things and experiences.

Narrative Violence

Before I continue, I want to stop and say that it is important to save for retirement and have an emergency fund. You’ll never know when an emergency will arise (losing a job, having medical problems, etc.). You don’t have to work forever. This article will tell you what to do after these are covered.

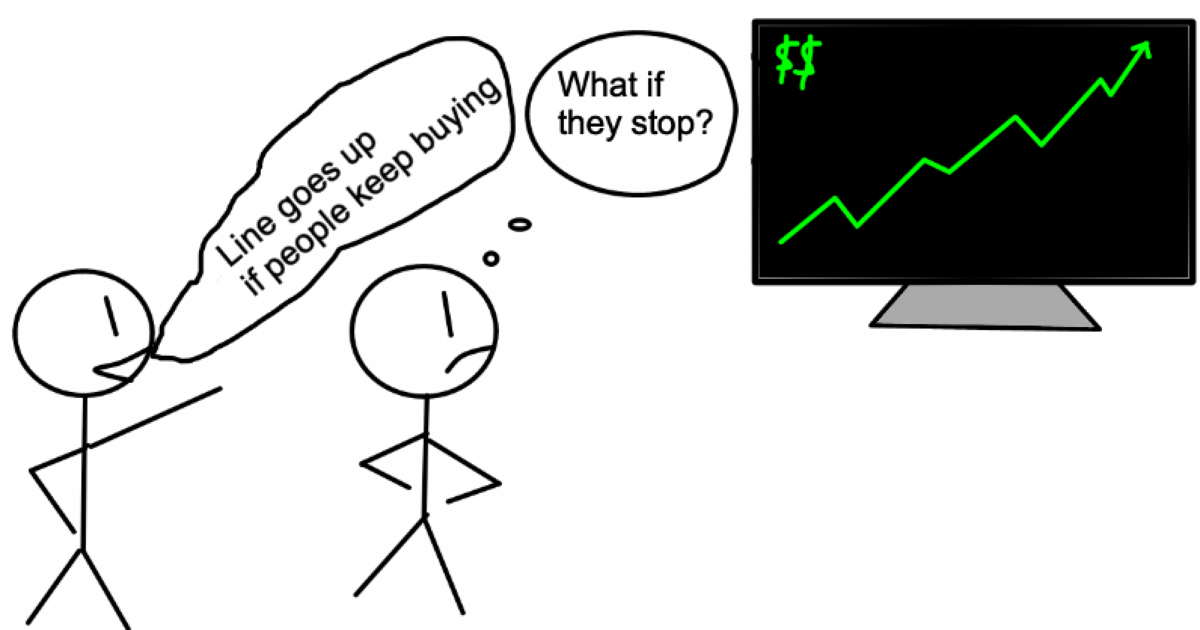

The most common financial advice is to “save as much as you can so that you’re set for retirement.” That’s fantastic. Saving for the sake of saving is not as profitable as you might think. It also takes less money to prepare for retirement than you think.

You’ll have $2.2M if you save $6,000 per annum for 40 years and the S&P continues to produce its historic 9% returns. If you save $10,000 a year, that’s $3.7M. As your income grows, so does your capital invested per year. Your portfolio can grow exponentially.

You don’t need to invest much if you earn $60k+ per year.

No one ever talks about what you do after you have saved enough. So we continue to save each extra dollar just for the sake saving. This is a story violation:

You are not being financially responsible if you avoid experiences constantly because you do not want to “waste money”. In the name of saving money, you are denying yourself of life’s experiences. “

It is a scandal that an aversion to all forms of spending money has been deemed the pinnacle for good financial behavior.

I have a question: Will you be happier later on in life if your friends don’t invite you to that trip? The money will obviously be more valuable in the future, but how about the value you get from it?

Time is an asset that has a finite amount. Money is a limitless asset. Your wealth will grow over time, but the opportunities to enjoy rewarding experiences with that money will diminish.

Saving the most money in your lifetime is not a reward. You’re going to be a multimillionaire at death? Congrats. Congratulations. The priest won’t fist-bump you in the grave for having so much money left over. You’re never going to be able cash in the chips you left on the table. I hope it was worth it.

It takes less than you think to prepare yourself for a comfortable retirement. Saving more than that is not financially responsible. It is also reckless.

Don’t give money to your future self that he won’t need. Instead, enjoy the experiences you have now.

Make More Money

The key to a successful future is balance. You need to make enough money to cover all your expenses, including investments.

It is more difficult to get there. The traditional advice is to reduce unnecessary expenses.

You’re always short of cash? Cut expenses.” Create a budget and stick to it. Monitor your expenditures. Beware of lifestyle creep. Et cetera, et cetera.

Despite this, the income side is not given much thought.

This is completely backwards because you have a limit to the amount of money that can be saved. Rent/mortage, transportation, food and other expenses are a must. You’ll also have to pay for a social life. While the amount may vary from person to person, we all have certain core expenses we must pay. You cannot cut your costs below these core expenses.

To increase your disposable cash, you need to increase your income. Income can grow indefinitely, while costs can be reduced only so far. Your cash surplus will be greater the further your income exceeds your costs.

A scarcity mentality is when you focus on the cost. “Oh, I can’t get out tonight because it’s so expensive.” “Oh, I’d love to take that trip but it is so expensive!”

Turn the equation upside down. Focus on earning enough money to be able to afford expensive activities instead of avoiding them.

This is not a message that says to ignore caution and FOMO when you get expensive invitations. This is not a message that you should avoid all costs in order to be financially responsible. Increase your income and your disposable cash to do what you want.

Disposable Income

The goal is to have a disposable income, which allows you to spend your money guilt-free. You can spend money and time as you please, without compromising your future.

You should then feel free to spend the money you’ve earned. You may feel responsible for saving every penny, but in reality you are wasting your money and starving yourself.

Matthew McConaughey says in Greenlights: “I would rather lose money having fun than to make money bored.” That’s true.

What have been your three most memorable experiences? It’s unlikely that any of your best experiences involved you skipping something to save money.

Spend money on experiences that are indispensable. In 60 years, I will be happy that I spent too much on the bachelor party of one of my closest friends. I won’t regret not letting it compound at 9% for 60 years.