Time is money. If a person can earn 10 shillings per day through his work, but spends sixpence on diversion, or is idle for half the day, that should not be considered as his only expense. He has actually spent or wasted five shillings.

Ben Franklin

Ben Franklin’s 1748 essay advice to a young tradesman, “Time is Money”, coined the phrase.

Franklin wanted to show the financial cost of laziness. He pointed out that if one is compensated for the time spent working, then minimizing the time not being productive will also reduce the money lost on other pursuits.

But I must disagree with the founding father on this issue.

Time is not money. Time is something more valuable.

In our daily lives, money and time are constantly at war. We sacrifice our time in order to make money. You have to work 40 hours per week in order to earn $1200. You sacrifice your Saturday morning in order to earn extra money by mowing the lawn. Then we spend money in order to gain time.

Spending $2000 for a vacation in the Florida Keys. You pay $500 for a maid to do your housework. Why? To save you time. And then the cycle continues.

Time and money are often treated as being equal, but for two reasons, they’re not.

- Money has diminishing marginal utility

- Money is infinite, but time is finite

Diminish Marginal What?

You may have heard of “diminishing margin utility” if you had an introductory Econ course in college. If you are unfamiliar with the term, marginal utility is simply the extra utility or enjoyment that comes from consuming a second unit of something. The classic example is as follows:

A hungry consumer gains a lot of utility when they eat one slice of pizza. As they become fuller, their satisfaction with each additional piece of pizza decreases.

The first bite of pizza was fantastic. The steaming triangles of pepperoni, cheese and melted mozzarella looked even better than they did when you hadn’t eaten for the day. The second and third pieces are still delicious but not as satisfying as that first one. You’ll be stuffed by the time you finish eating the entire pizza. An 11th piece is of no added value. You’re probably disgusted by the fact that you ate a whole pie all by yourself.

Though we don’t often think of money in this way, it is the same. Our minds are always focused on how we could spend a little more money.

If I receive this raise, I will be able to afford the beach house in Florida.

If I close this deal I can pay for my trip to Hawaii.

If I become a partner in my firm, I will be financially secure for the rest of my life.”

This 1:1 relationship between income and happiness is our perception. We have a 1:1 perception of income and satisfaction.

You don’t believe me. Purdue University conducted a study that found happiness from increased income to plateau after $105,000.

What is the relationship between income and satisfaction? Below is a graph that shows the relationship between income and satisfaction.

Decreased marginal utility

It makes sense if you think about it. When your income is low, an additional dollar can have a huge impact on your lifestyle.

Let’s say you earn $30,000 per year in Atlanta. Rent and utilities of $1,000 per month will make it difficult to pay your bills and put food on your table. You won’t have any money left over for extras. If your income is $50,000, you’ll be able to live comfortably. Rent is not a concern. You won’t be able to take a lavish vacation or attend hawks games courtside, but you will still have enough money for next month.

Scale up to $100,000 per year. You can take out $25,000 in taxes, and $12,000 to cover this year’s utilities and rent. You’ll have $63,000 left over to spend on whatever you like. You want to go skiing in Park City. Sure. Why not? Why not? Why not? No problem. No Ferrari, no Aspen vacation home, and no private jet. But you can do pretty much anything you want.

You can get a bigger house, a nicer car, tastier meals and better clothing as your income increases, but you won’t be able to travel or try anything new. Spending more on upgrades is the only way to go. All the rest is an extra.

It is true that extravagant wealth can be a paradox.

Losing luxuries after experiencing them can make life even worse. – Nassim Taleb

Time, the X Factor

You get a little less pleasure from every additional dollar. What does it matter? As long as you still gain something, isn’t that enough? Father Time is here to help. You’ll probably need to sacrifice some time if you want to earn that extra dollar. Income and time are more important than money and happiness.

You might work 40 hours a week and earn $65,000. You don’t have to do overtime or work weekends. Your cousin works in investment banking. He earns $200,000 per year. He works from 8 pm to midnight about half the time and is on call every Saturday. He’s earning a lot more than you.

What about his time?

We humans spend a great deal of time fantasizing over the next job. Next promotion. Next pay raise. We rarely consider the time we are giving up.

Every decision we make is driven by the opportunity costs. A career choice is different from a dozen other choices. choosing one partner does not mean selecting a thousand others. Choosing not a million other things is choosing to do something on a particular day.

We can’t get back the hours, days or years we spend on our own.

What is the relationship between time and money?

- You have 4 680 weeks to live on the planet if you live 90 years.

- Every additional dollar earned requires additional labor (time).

- After $100k, the happiness derived from every additional dollar drops rapidly

How much of your limited life are you willing sacrifice to get unlimited money? How much of your limited time are you willing to sacrifice in order to increase your net wealth?

Let’s ask the opposite question: What amount of money would Jeff Bezos be willing to give up in order to become 25 again?

What are the real values of all those billions?

Three Thoughts

Three conclusions can be drawn from the relationship between time and money.

- You must find “enough”

- Invest in

- There is always more money to be made

Enough

Enough varies depending on the person. Even within a person’s own life, it can change as circumstances change

enough might mean $100k when you are single at You might want to buy a beach home or go on expensive vacations. You may live in a more expensive city or a cheaper suburb.

It’s less important to know the number that represents your enough than to find Enough is the point where you should focus less

Invest

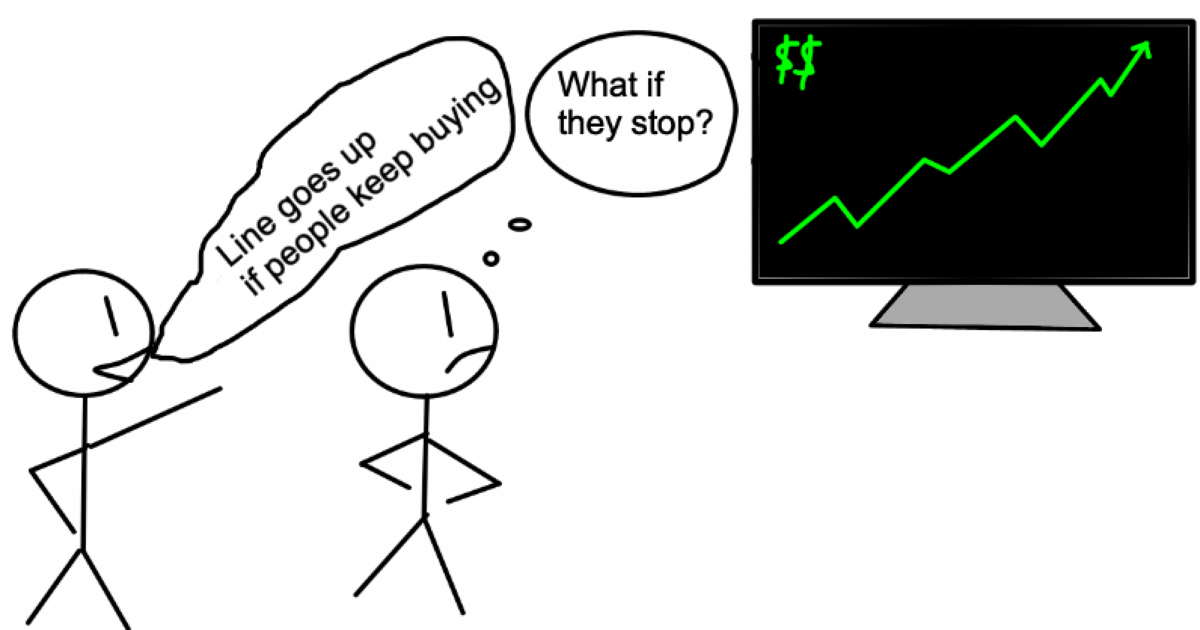

Investing allows us to grow our money and not sacrifice any time. You can invest your money in real estate or the stock market and do what you

Early and frequent investing is the best way to achieve financial freedom.

You can maximize your life style by investing every dollar you do not need and being

You will never be able to escape from your job if you spend all

Just Make More

You should find the amount that you need to live a happy Minimizing every expenditure can also be harmful.

There is no limit to your net worth. There are only so many things you can cut. Rent, food and transportation will be necessary at some point. You shouldn’t be forced to miss out on weekends with family and friends or

Guess What? Cool shit is expensive. And I won’t sacrifice amazing experiences to save money. The whole purpose of saving money is spending it.

As you age, your money’s flexibility also decreases.

A $1000 roadtrip in your 20s with friends could change your entire life Will that money be better spent on your deathbed at 90? Nobody cares who has the most extravagant funeral.

Earn the money you need to enjoy the experiences you want.

Wrapping up

Time is finite, but money is unlimited. You need to maximize your enjoyment of the game by knowing how much is enough. You also need to earn money without sacrificing any time and be able afford to have the experiences you desire in life.

What if you spent all your money? Make more. How do you spend your time? Rest In Peace.